georgia film tax credit requirements

How to File a Withholding Film Tax Return. Purposes of the Film Tax Credit.

Credit Code 122 company name is the movie company no certificate 100 owner Federal EIN No and Credit Amount.

. 159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production. For the rental of Georgia real property or property that is affixed to such property such as a stage the vendor does not have to meet the Georgia vendor requirements. Third Party Bulk Filers add Access to a Withholding Film Tax Account.

You will receive a red errorwarning message about K-1s which you can ignore. 159-1-1-04 Base Tax Credit Certification Application Process. June 3 2019 1217 PM.

Instructions for Production Companies. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. Note if other services are rendered by the provider the normal rules would still apply.

Claim Withholding reported on the G2-FP and the G2-FL. All productions with credit more than 250000000. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

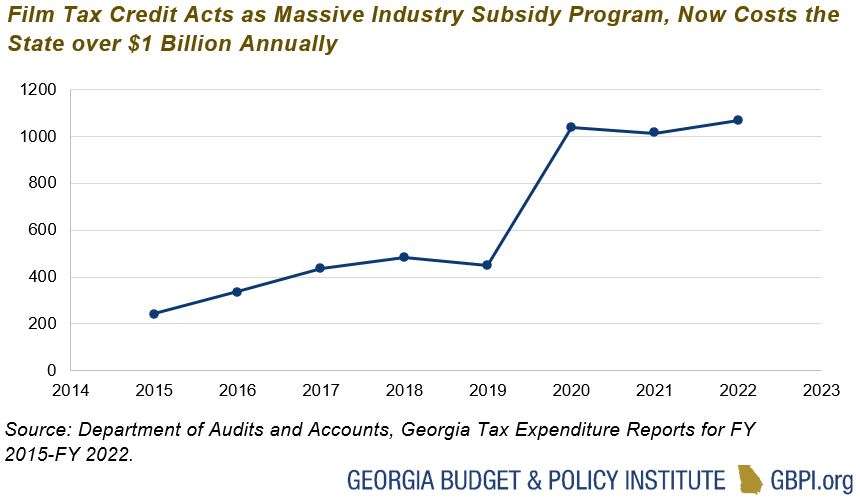

How-To Directions for Film Tax Credit Withholding. Georgias Entertainment Industry Investment Act provides a 20 tax credit for filming and entertainment industries that spend 500000 or more on production and post-production either on single or multiple projects. In 2019 Georgia gave out 850 million in credits.

Georgias film tax credit is unique because it has no cap and is transferable. 1800 Century Blvd NE Suite 18104Atlanta Georgia 30345. This 50000 would apply to current year or prior year taxes owed and any remaining amount could be carried over up to five years.

Withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees. Certification for live action projects will be through the Georgia Film Office. Audits are required for Film Tax Credits based on the date the production was certified by the Department of Economic Development DECD and the amount of credit.

Click to learn additional information and to obtain the GDORs application form. More than the state spends on child welfare or state prisons or public health. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out.

A final tax certification is not required before January 1 2023 for. The Georgia Department of Revenue GDOR offers a voluntary program. 15-25 for residents and 15 for non-residents.

The audit is requested through the Georgia Department of Revenue website GDOR and. The Georgia film tax credit long one of the worlds most generous subsidies for the entertainment industry. Georgia Film Tax Credit Audit Procedures Manual May 11 2022 Page 2 Projects certified by GDEcD on or after January 1 2022 to a production company if such tax credit sought for the project exceeds 125 million.

Projects first certified by DECD on or after 1. Companies for services performed in Georgia when getting the Georgia Film Tax Credit. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

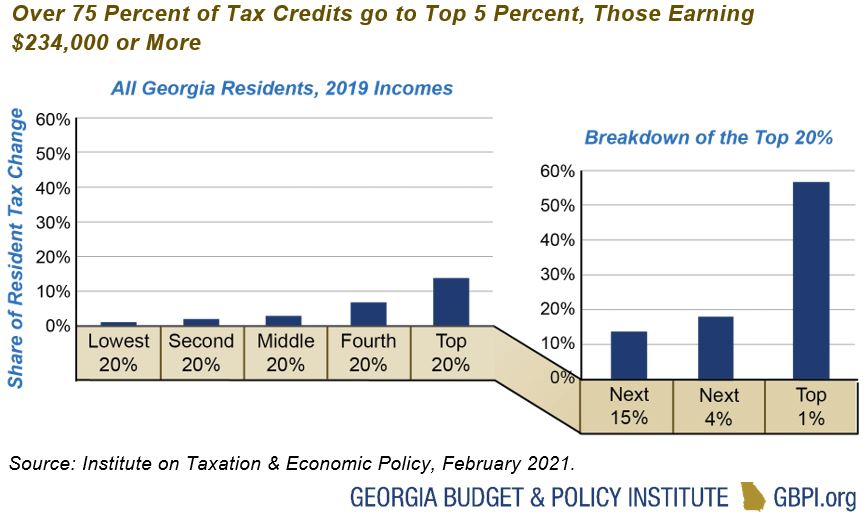

Transferability means more than just film companies benefit from the tax credits. Projects first certified by DECD on or after 1121 with credit amount that exceeds 250000000. The state grants an additional 10 tax credit if the finished project includes a promotional logo provided by the state.

Taxpayers have the ability to purchase these credits retroactively for up to three years. All productions with credit more than 125000000. Most of the credits are purchase for 87-92 of their face value.

Learn about the changes to the Georgia Film Tax Credit scheduled to go into effect in 2021 and new requirements including an independent audit - Atlanta CPA. Georgia Department of Revenue. 159-1-1-05 Qualified Productions Production Activities.

Minimum expenditure threshold can be met with one project or the total of multiple projects aggregated in. On August 4 2020 Governor Kemp signed into law HB. In addition tax credits cannot be transferred until the audit is completed.

GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. The new law appears to be in response to an audit report issued by the Department of Audits and Accounts DOAA earlier this year that called into question the. Register for a Withholding Film Tax Account.

There is a tiered system that is based on the estimated tax credit value. To qualify for the film industry tax incentives at least 50 of the principal photography must be in Virginia. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability.

For services performed in Georgia. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax. And music videos that are distributed outside of Georgia.

TABLE OF CONTENTS. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter.

Georgias film tax credit is massive. FILM TAX CREDIT. This is an easy way to reduce your Georgia tax liability.

159-1-1-03 Film Tax Credit Certification. A Base Certification Application may be submitted within 90 days of the start of principal photography. The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits.

Television films pilots or series. Eligible production types for the tax credit in Virginia are commercials documentaries feature films pilots scripted television and video games. Direct contact for an audit inquiry.

In 2022 the requirement will then apply to productions claiming more than 125 million in tax credits and 2023 it will apply to all productions in the state. Starting 2021 audits will be limited to productions seeking a film tax credit for more than 25 million. So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500.

B Georgia Real Property Exception. The verification reviews will be done on a first comefirst serve basis.

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Scraps Bill To Cap Its 900 Million Film Incentives Barring Sale Of Tax Credits Update

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Georgia Films Top Box Office Georgia Department Of Economic Development

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

The Two Of Us South Georgia Film Festival 2020 Call For Entry Two By Two Film

Essential Guide Georgia Film Tax Credits Wrapbook

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Essential Guide Georgia Film Tax Credits Wrapbook

The Secret Sauce Of Georgia S Extraordinary Film Industry Georgians Saportareport

Georgia Film Records Blockbuster Year

Pin On Cc Color Correction Color Editing And Sfx

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute